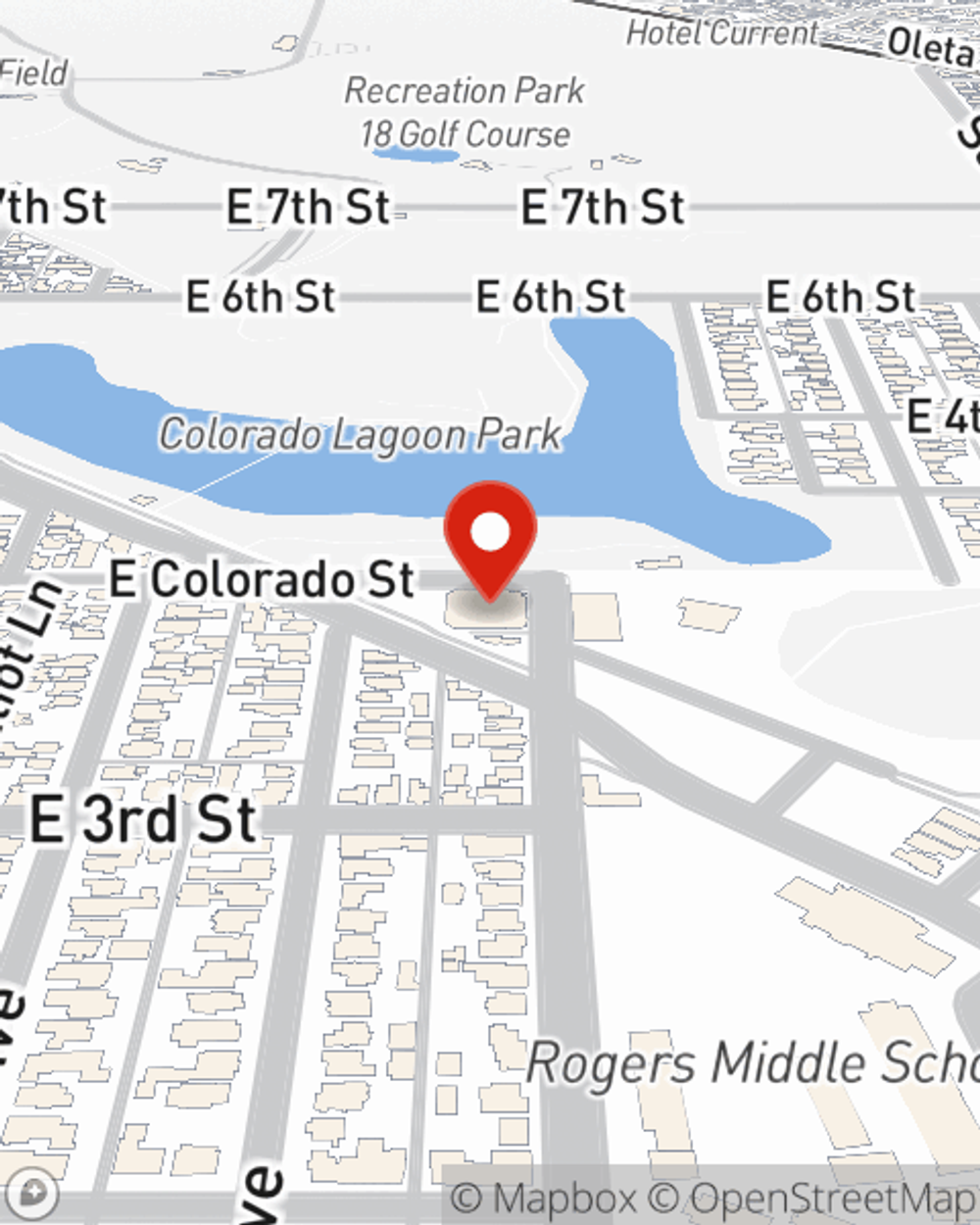

Life Insurance in and around Long Beach

Protection for those you care about

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It can be a big deal to provide for your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can pay for college and/or pay off debts as they grieve your loss.

Protection for those you care about

Don't delay your search for Life insurance

Life Insurance You Can Trust

Fortunately, State Farm offers various coverage options that can be personalized to match the needs of those you love and their unique situation. Agent Keir Jones has the personal attention and service you're looking for to help you purchase coverage which can assist your loved ones in the wake of loss.

Simply reach out to State Farm agent Keir Jones's office today to learn more about how the State Farm brand can work for you.

Have More Questions About Life Insurance?

Call Keir at (562) 433-5573 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.