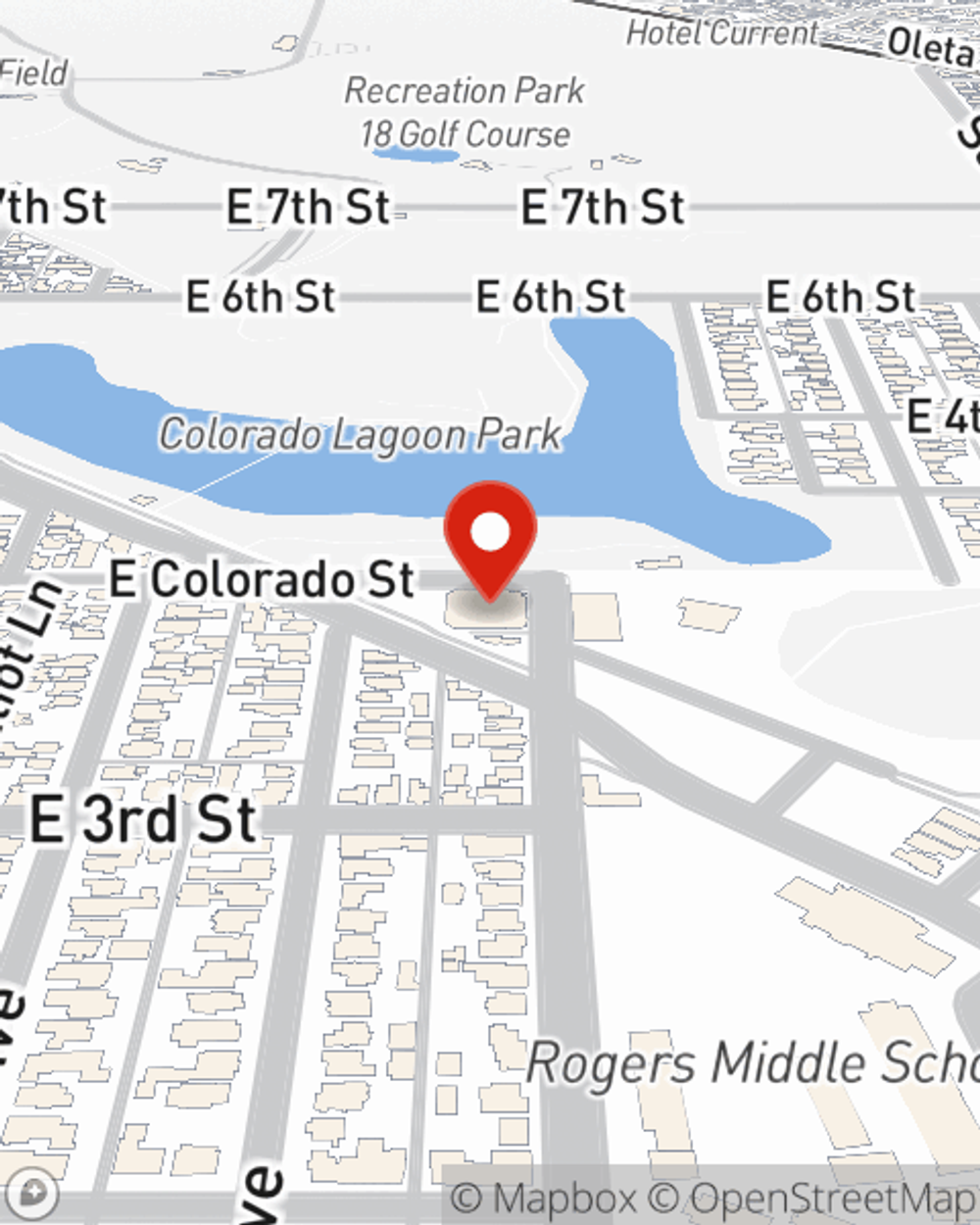

Condo Insurance in and around Long Beach

Townhome owners of Long Beach, State Farm has you covered.

Cover your home, wisely

Home Is Where Your Heart Is

As with anything in life, it is a good idea to expect the unexpected and try to prepare accordingly. When owning a condo, the unexpected could look like damage to your unit and personal property inside from theft smoke, weight of sleet, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Townhome owners of Long Beach, State Farm has you covered.

Cover your home, wisely

Why Condo Owners In Long Beach Choose State Farm

Despite the possibility of the unpredictable, the future looks bright when you have the fantastic coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condominium and personal property inside, you'll also want to check out options for replacement costs possible discounts, and more! Agent Keir Jones can help you develop a Personal Price Plan® based on your needs.

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Visit agent Keir Jones today to get started.

Have More Questions About Condo Unitowners Insurance?

Call Keir at (562) 433-5573 or visit our FAQ page.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.